BUSINESS TRANSFER AND TAKEOVER

Free 30-Min Consultation For Business Takeovers

Business takeover and transfer are key moments in the life of a company, often synonymous with new challenges and opportunities. As your chartered accountant firm, located in Levallois-Perret, France, we are committed to supporting you at every stage of these crucial processes, ensuring a successful and beneficial transition for all parties involved.

OUR APPROACH TO BUSINESS TAKEOVER AND TRANSFER

We understand how important these steps are to the continuity and development of your business. Our team of experts is here to advise you, whether you are planning to transfer your company or take over an existing business, including your plans for external growth.

In practice, a business transfer & transfer can last an average of 12 to 18 months. It’s a major investment, and there are a number of stages involved.

Our Business Transfer & Takeover Services

Business Valuation

We carry out an accurate valuation of the business to be transferred or taken over, taking into account all financial, operational and strategic factors. How can you sell your business at the best price? We need to list the strengths and weaknesses of the business by establishing a diagnosis of its activity, means of production, human resources, finances, legal status, quality, safety and environment.

Preparing for the Business Takeover

We can help you prepare your business for transfer, optimizing its value and ensuring continuity of operations. It is important to be able to justify to the future buyer your asking price.

Assistance During A Business Takeover

For buyers, we offer comprehensive support in the acquisition process, from identifying potential targets to negotiating and finalizing the takeover.

Business Takeover Financing Strategy

We develop tailor-made financing strategies to facilitate the transfer or takeover, identifying the best sources of financing and available grants. Our firm can help you in your search for financing by putting our network of banks at your disposal, and by preparing financing applications tailored to your situation.

Legal and Tax Counsel for Business Takeovers & Transfers

Our support includes legal and tax advice to secure the transaction and optimize the tax aspects of the transfer or takeover. Once we’ve agreed on the price, we’ll work out the legal arrangements best suited to your situation and objectives. The aim is to optimize future taxation.

Post-takeover Integration

We support you in the post-acquisition phases to ensure the successful integration of the acquired company, with an emphasis on change management and optimizing synergies.

Why Choose Us to Handle Your business takeover & transfer

- Comprehensive Expertise

- Personalized approach.

- Trusted partner.

- Extensive network.

An important step in the life of an entrepreneur: transferring your business. It’s essential to take stock of your situation and analyze the reasons behind your project. A sale has to be prepared, so you need to draw up a schedule for the transfer and prepare the important stages in advance, so as to optimize the benefits of passing on your business.

The takeover and transfer of a business are strategic steps that require specialized preparation and support. RODEC Conseils is at your side to help you make the most of these important moments.

Let’s begin your business takeover & transfer process.

FAQs

What are the main challenges involved in taking over a business?

Challenges can include valuing the business, financing the takeover, legal and tax aspects, as well as post-takeover integration and change management.

How can RODEC Conseils help finance a business takeover?

We can help you draw up a sound financial plan, find suitable financing (bank loans, investors, public grants) and prepare your financing file.

How long does a business takeover take?

The length of the transfer process can vary considerably, depending on the complexity of the business and market conditions. It is advisable to start preparing for the transfer several years in advance.

Business Transfer & Takeover is a delicate process.

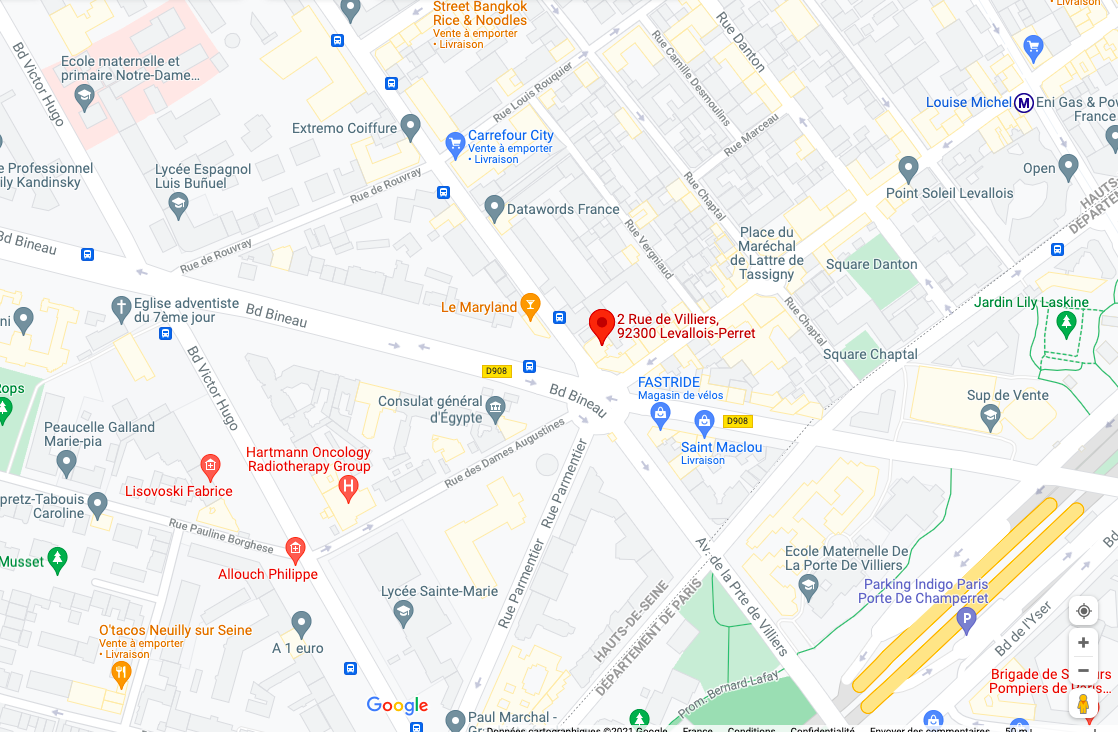

ADDRESS:

2 bis rue de Villiers 92300 Levallois Perret

EMAIL:

contact@rodecconseils.com

PHONE:

NEWSLETTER

Subscribe to the newsletter to receive our lastest news.

Rodec Conseils © 2024 • Contact • Legal & Privacy